By Nia Holland

2024 W.E.B. Du Bois Fellow

1. Introduction and significance

After the Servicemen's Readjustment Act of 1944, or the GI Bill, was signed into law by President Franklin D. Roosevelt, the United States experienced a significant increase in college enrollment. The GI Bill was designed to aid veterans in their readjustment to civilian life by covering the costs to pursue further education at a college or university. In the decade following the bill's enactment, the number of degrees awarded by colleges and universities in the United States more than doubled, largely due to the opportunities the bill provided (National Archives, 2022). This surge in educational access set a precedent for higher education as a pathway to economic stability and social mobility.

Since that time, college enrollment has continued to rise, along with the associated costs of attendance. According to the National Center for Education Statistics, college enrollment peaked between 2010 and 2011, with approximately 18.1 million students enrolled across the United States. However, the cost of attending college has risen even more dramatically. Between 2010 and 2022, tuition rose an average of 12% per year, and since 1963, it has increased 749% on an inflation-adjusted basis (Hanson, 2023). This substantial[JS1] increase in tuition has outpaced income growth, making higher education increasingly unaffordable for many (Council on Foreign Relations, 2024).

The rising cost of education has necessitated large student loan debt for many students, especially those from marginalized communities, who often have less generational wealth and face greater financial barriers. Currently, U.S. borrowers collectively owe nearly two trillion dollars in student loan debt. Students from Black, Latino, and American Indian communities often take on more debt than their White counterparts and are more likely to default on their loans. This is significant because these students are often in greater need of the social mobility that higher education can provide. Yet, the burden of student debt can prevent them from fully benefiting from their education, perpetuating cycles of poverty and inequality[JS2] .

Given the history of higher education financing in the U.S. and the disparate impact of student loan debt, it is crucial to explore broader public opinion on this issue. Although education and student loan debt have long been central issues in American politics, polling suggests that the issue is sometimes overshadowed by other concerns. For example, a 2017 CNN poll found that 24% of respondents named health care as the most important issue facing the country, compared to just 2% naming education. However, more recent polling by Reuters in January 2024 found that nearly half of those surveyed indicated government efforts to lower student debt burdens would be at least somewhat important in determining their vote, with 3% identifying it as the most critical issue, suggesting that student loan debt and affordability of higher education remain salient issues in the current American political landscape.

This exploratory paper examines current public opinion on student loan debt relief in the United States and discusses implications for education policy and future research.

2. Discussion and future implications

Public opinion on education, including the accessibility of higher education and student loan debt, has been a focus of various market research and polling organizations for years. These polls are critical not only for understanding current viewpoints but also for predicting which issues may shape upcoming state and national elections. They provide a framework for politicians to address these concerns during their terms in office.

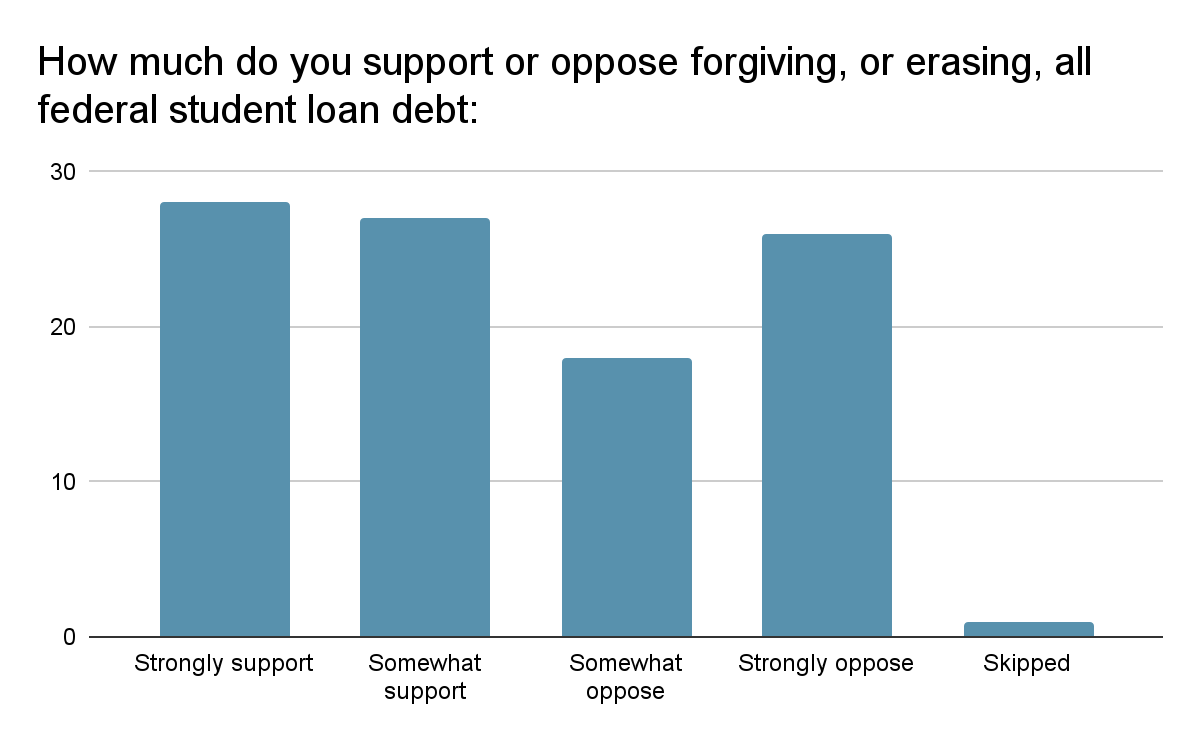

In a 2021 web-based poll sponsored by Axios, approximately 2,000 U.S. adults were asked about various social issues, including the cost and value of higher education. One survey question asked, “How much do you support or oppose the following policies regarding higher education?...Forgiving, or erasing, all federal student loan debt?”. Over 50% of respondents said they either “Strongly support” or “Somewhat support” the complete erasure of all federal student loan debt, compared to only 26% who indicated they “Strongly oppose” federal student loan debt forgiveness (see Figure 1).

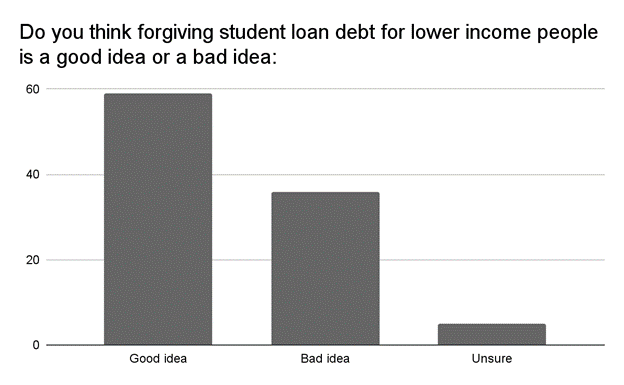

In a similar 2019 poll sponsored by NPR and PBS NewsHour, respondents were asked whether they believed forgiving student loan debt for lower-income individuals was a good or bad idea. The results were even more striking, with nearly 60% indicating it was a good idea, compared to only 36% who thought it was a bad idea (see Figure 2).

In both polls, support for federal student loan debt relief was significantly higher among Democrats than among Republicans or Independents. For example, 45% of Democratic respondents said they “strongly support” forgiving or erasing all federal student loan debt, compared to only 12% of Republican respondents. Regarding debt forgiveness for lower-income individuals, 85% of Democratic respondents supported the idea, compared to only 32% of Republican respondents.

3. Discussion and future implications

This exploratory analysis provides important insight into current public opinion regarding federal student loan debt forgiveness, suggesting that many Americans support some form of debt relief in response to the student debt crisis. Given the rapidly increasing cost of college and the resulting rise in student loan debt, this issue remains highly pertinent to public opinion and public policy.

Future research should explore other demographic factors, such as race and age, that may influence public opinion on student loan debt relief, as well as how these factors affect voting behavior. Additionally, a comparative politics approach could provide valuable insights into why and how the United States' approach to higher education policy and funding differs so significantly from other wealthy nations. Understanding these differences may be key to developing more equitable and effective education policies in the United States.

References

Axios. (2021). Axios/Ipsos Hard Truths Higher Education Poll: August 2021 (Version 2) [Dataset]. Roper Center for Public Opinion Research. doi:10.25940/ROPER-31118577

Cable News Network (CNN). (2017). CNN Poll: August 2017 - Poll 7 (Version 3) [Dataset]. Roper Center for Public Opinion Research. doi:10.25940/ROPER-31114428

Council on Foreign Relations. (2023). U.S. student loan debt: Trends and economic impact. https://www.cfr.org/backgrounder/us-student-loan-debt-trends-economic-impact

Hanson, Melanie. “College Tuition Inflation Rate” EducationData.org, August 13, 2023, https://educationdata.org/college-tuition-inflation-rate

Looney, A., & Yannelis, C. (2015, September 15). A crisis in student loans? How changes in the characteristics of borrowers and in the institutions they attended contributed to rising loan defaults. Brookings. https://www.brookings.edu/articles/a-crisis-in-student-loans-how-changes-in-the-characteristics-of-borrowers-and-in-the-institutions-they-attended-contributed-to-rising-loan-defaults/

National Archives. (2022, May 3). Servicemen's Readjustment Act (1944). https://www.archives.gov/milestone-documents/servicemens-readjustment-act

NPR/PBS NewsHour. (2019). NPR/PBS NewsHour/Marist Poll: December 2019 (Version 2) [Dataset]. Roper Center for Public Opinion Research. doi:10.25940/ROPER-31116969

Reuters. (2024). Reuters/Ipsos Large Sample Survey 1: January 2024 (Version 2) [Dataset]. Roper Center for Public Opinion Research. doi:10.25940/ROPER-31120717

U.S. Department of Education. (2023, July 18). Biden-Harris administration releases first set of draft rules to provide debt relief for millions of borrowers. https://www.ed.gov/about/news/press-release/us-department-of-education-begin-federal-student-loan-collections-other-actions-help-borrowers-get-back-repayment

U.S. Department of Veterans Affairs. (2024, July 17). Post-9/11 GI Bill (Chapter 33) payment rates for 2022-2023. U.S. Department of Veterans Affairs. https://www.va.gov/education/about-gi-bill-benefits/post-9-11/#:~:text=What%20benefits%20can%20I%20get,update%20those%20rates%20each%20year